Gap year blogs

Personal stories - Tips and advice - Programme insights - Latest newsCreating Budget-friendly Gap Year Travel Plans

Charlie Fletcher is a freelance writer from the lovely "city of trees"- Boise, Idaho. Her love of writing pairs with her passion for social activism and search for the truth. You can find more of her writing on her Contently. A budget friendly gap year is the perfect...

Take a gap year – shape your future

If there was any doubt about the arrival of this post-pandemic “new normal”, then the beginning of June festivities cleared it. The Jubilee long weekend came as a breath of fresh air to people wanting to feel normal again. Meeting friends (and strangers) face to face,...

Embrace the digital nomad life on your gap year

The digital nomad lifestyle is a path toward independence, adventure, and empowerment and a revolution is taking place outside the confines of conventional employment and a fixed workplace.

7 Tips For Choosing the Perfect Gap Year Destination

We've highlighted 7 tips for choosing the perfect gap year destination. A staggering 98% of respondents in a Gap Year Association survey said their gap year helped them mature and better interact with people of various cultures and backgrounds. In addition, 97% said...

4 Pre-travel tips for your gap adventure

These pre-travel tips will help you get the most out what is a life-enriching opportunity. During a gap year, you get to spend time exploring another part of the world (or your own country) before heading to university or the workforce. And you'll encounter different...

Great careers for women

When it comes to great careers for women, most of us spend a lot of time and effort on finding the right one. We want to make sure that we are doing something that we love, and that is also financially rewarding. It's important to remember that our careers are a huge...

Handling the stresses of teaching overseas

Preparing how to handle the stress of teaching overseas will really improve your experience. Teaching English in a foreign country as part of your gap year is likely to be one of the most demanding experiences you'll ever have. It entails relocating to a new country,...

Travel in 2021

It's been a terrible year for most people with too many facing the loss of family, their health or employment. Talking about gap years and travel in 2021 can seem frivolous by comparison. That said, the travel industry has been one of the hardest hit by restrictions...

Should I go to university or take a gap year?

Firstly, we'd like to wish everyone the best for their continued studies this year. We know it's been a really difficult period for students. The uncertainty around exam results, university places and employment have understandably left many feeling in a state of...

Boost your well-being during Covid19

For students around the world, the plans for a 2020/1 gap year changed dramatically as a result of the coronavirus crisis. If you’re one of those students whose plans got completely warped amid the crisis, time to look on the bright side. There are ways to use this...

Watch Netflix overseas

Watch Netflix Overseas: Even whilst enjoying a brilliant adventure overseas, you may sometimes crave a bit of home life. Pancakes, Your own bed or favorite TV show. It’s no secret that Netflix US has the largest library out of all available regions – sitting at over...

Deal With Language Barriers While Traveling S.E. Asia

How to Deal With Language Barriers While Traveling to S.E. Asia by Erica Sunarjo So, you have picked your travel destination. South East Asia, it is! Your bags are packed, and your flight booked. You have pondered a list of sights you want to visit, With the many...

5 Common Travel Challenges

Travelling is not always easy and you will most definitely get into unexpected situations. However, some of these can be foreseen and prepared for. Here are 5 common travel challenges you will face while traveling abroad. Being Unprepared This is an...

How to choose more sustainable travel kit

Taking a gap year is all about gaining new experiences and a new perspective on life. When you choose to take time off from work or school, you know that your lifestyle will change. You will also gain a new appreciation for the world around you. How to choose more...

How to Avoid 5 Gap Year Mistakes

Successful gap years require a strategy and this blog will help you avoid 5 gap year mistakes. Gap years have long been popular in Europe and are gaining more traction in the United States—and for good reason. According to a Gap Year Association survey, study abroad...

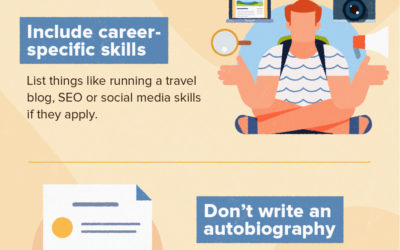

Evidence the benefits of your travel on a CV

Gap years have been around since the 1970's but the last decade or two have seen more people than ever before deciding it's an option for them. In a globalized world, businesses need experienced candidates who understand other cultures, speak another language or are...

How to travel with only a backpack

How to travel with only a backpack: Travelling light can be extremely liberating. When you travel light, you’re often able to go off the beaten path and find some hidden gems that you wouldn’t otherwise find. However, most of us are prone to overpacking and it can be...

How to prepare your gap year finances

Taking a gap year between secondary school and higher education offers a variety of valuable opportunities. These promote personal growth and experiential education. Students can volunteer or create additional time to explore a degree they want to pursue. Additional...

4 Things to Research in Advance to Stay Safe Abroad

It’s hard to get banned from Canada, but I know someone who did. He didn’t do anything illegal. But because he didn’t research Canadian laws and customs before visiting, he did some things at the border that the customs agents found suspicious. The result? An arrest...

Graduate Gap Opportunities in Africa & Asia

If the end of your degree is fast approaching then you are probably starting to think about what comes next. Will you rush straight into your first graduate job or will you choose to take graduate gap opportunities in Africa and Asia? If you dismissed the idea of a...